Personal Banking

Personal Card Products

Premium Banking & Investments

Fees & Service Charges

MCB's reporting obligation

Client feedback

Foreign Account Tax Compliance Act (FATCA)

Update Account

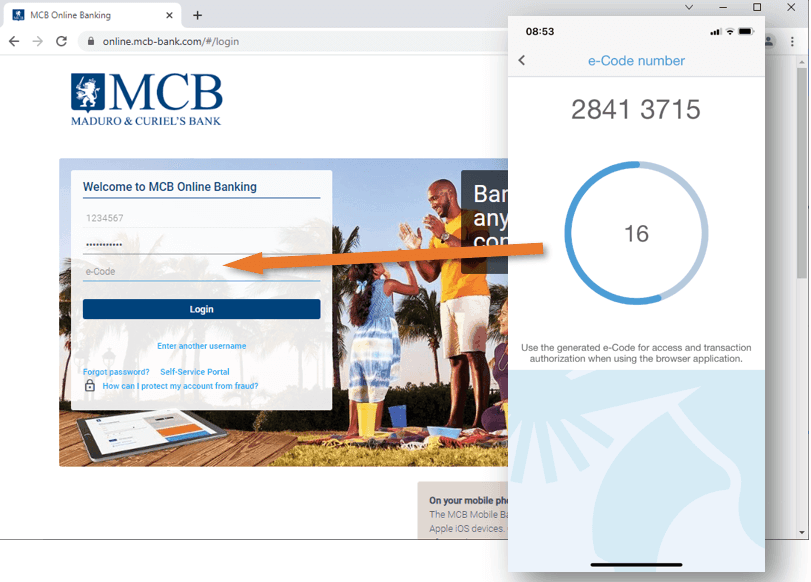

Easy Banking

Currency Exchange Rates

Personal Banking

Personal Card Products